Three Ways to Estimate through Material Cost Surges

This article was written by Julie Huval, FSMPS, CPSM, Head of Marketing at Beck Technology, and published in the July/August 2021 edition of DCD Magazine.

Unless you have been estimating from under a rock this year, you know that material costs have skyrocketed in 2021. So much so that some projects have delayed starts, and others are getting creative in finding the supplies needed to keep the project schedule on track.

Preconstruction is equal parts art and science. Knowing how to price a project, prep for scheduling snafus, and forecast how the market will fluctuate are unique and necessary skill sets to not only winning projects but helping keep company margins where they should be. However, when material costs are creeping up (seemingly) every hour, estimators are in the hot seat to keep customers happy while not losing the shirt off the company’s back.

What’s Causing Material Costs to Escalate?

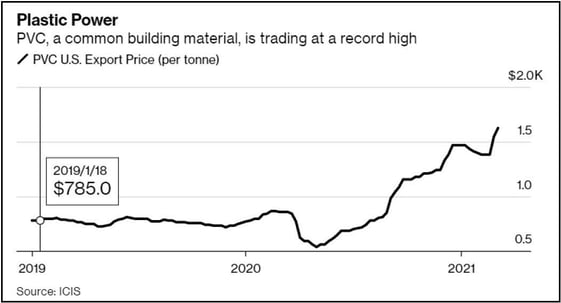

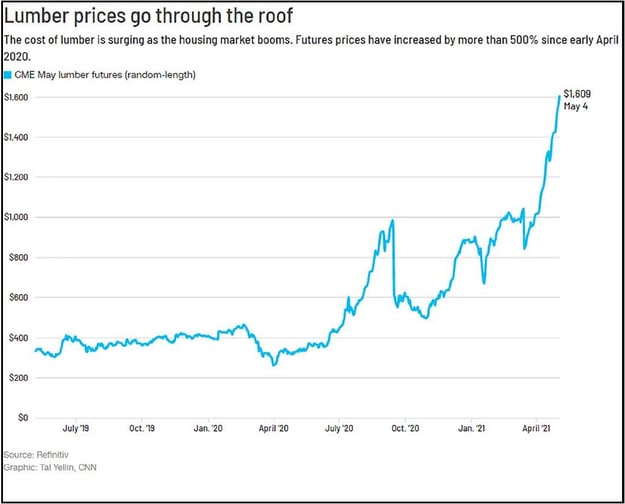

The four construction materials that are causing havoc at the moment are steel, lumber, aluminum, and PVC. Steel prices so far this year have increased 40%. Aluminum has gone up 30% since February. Lumber prices have increased 500% since April 2020.

PVC shortages are still hindering the construction industry and, with demand going up, the prices follow. The winter storm that hit Texas and Louisiana in February 2021 affected the chemical plants that supply manufacturers of PVC. Those plants are slow to come back online, and the export request for PVC continues to rise.

At the beginning of the COVID outbreak, factories and mills shut down. Lumber mills were preparing for a slump in demand, but the opposite happened. Residential construction (both new builds and renovations) was in high demand during 2020, and the mills were not able to come online fast enough to supply the need.

Transportation costs have also increased, so the price of getting materials from suppliers to project sites has risen. The cost of diesel has quickly rebounded to prices we saw prior to 2020. Additionally, the global shipping industry is being tasked with bringing in more containers and clogging up ports. So, materials are slower to leave port and get to distribution facilities. The combination of diesel prices going up and materials taking longer to arrive at ports and distribution facilities is adding to the material costs for project sites.

Crystal Ball

So, the big question is, “When will the cost normalize?” If you have the answer, please share! Some think the price upswings will adjust to normal rates at the end of 2021 or the beginning of 2022. Lumber will likely set a new market regularity to arrive at a higher price point than what we saw in 2019, but not as high as the jumps we are seeing today.

Construction estimators are dealing with the stressors of these increases as they screw up estimates and bust budgets. Then there are the projects that get updated costs—causing project owners to delay the start date until prices normalize. The “wait and see” game is a nightmare for construction companies as they forecast projects.

However, architecture hiring has been on the upswing, which is a positive indicator of future projects. When project owners are asking for designs then they are also prepping for building.

Powering through Estimates while Protecting Business

Powering through Estimates while Protecting Business

An estimator can put some foundational items in play to help protect contingencies and profit margins. Some projects are seeing an uptick in prices by almost 25%! That sticker shock does not bode well for anyone...not the builder and not the project owner. A few recommendations from estimating peers include:

Time Limit on Estimates

Include wording on estimates that prices are good for a specific amount of time and try to keep that timeframe as tight as possible. Some estimators are clearly stating that prices are good for 14 days. Even then, the cost of materials may go up during that time period. But most estimates prior to October 2020 had a time limit of 90 days. Times have definitely changed! If you have access to cost trends for the past six months, you’ll have a clearer picture of increases over a specific amount of time and can make the judgment call on how long your estimates are good for.

Purchase Order On-Hand

Let the manufacturer or supplier know you have a purchase order on hand to lock in the rate. Because of the increase in demand, manufacturers and suppliers cannot guarantee the materials you need will be available if you are waiting on approvals. This will require you to either find another source for materials or will require them to source it for you and add additional costs to the original amount. Having a purchase order approved and ready to go helps manufacturers and suppliers know you will be moving forward with the project as soon as possible. No one has the luxury to wait on an approval process during these cost escalations.

Clauses

Adding wording to estimates to help set the tone and expectation of price increases will help in difficult conversations down the road. Items to include in clauses that may affect pricing and lead times (which will skew your delivered estimate) are delays in signing a contract, in issuing purchase orders, and in approvals and building permits. Whatever nuances of a project that could affect schedule and timeliness of forwarding progression should be explicitly stated in an estimate clause. Keeping the increased material costs in check is a team sport, and collaboration across all project stakeholders is needed.

Lean on Relationships

Now more than ever, having solid relationships with subcontractors, suppliers, vendors, and manufacturers will save your sanity during this volatile time in construction. While the supply chain will normalize eventually, that doesn’t mean the construction industry gets to wait it out. Being able to call up a trusted friend who also happens to be the subcontractor and get an updated quote will keep your estimate on track. They know you aren’t trying to pull the wool over their eyes, and you can be confident in the information they are providing you at the 11th hour.

Plus, the more you talk with the folks in your network, the better you’ll have a feel for the pulse of the industry. While we are weathering the storm of price increases, we also want to be the ones who have a clearer picture in the crystal ball so we can make better project decisions when costs normalize.

-1.png?width=112&height=112&name=image%20(4)-1.png)