Factors Driving the Construction Labor Shortage

Although all industries feel the impact of the recent labor shortage, it's especially impacting the construction industry.

Although all industries feel the impact of the recent labor shortage, it's especially impacting the construction industry.Back in 2008 when the subprime mortgage crisis fueled the housing market collapse, the construction industry entered its boom and bust cycle from its pre-recession peaks. Twelve years later and with a pandemic hit, the construction labor shortage hasn't fully rebounded from its long-term slump and continues to worsen as the new paradigm shifts from the Great Recession to the Great Resignation.

Before sounding the alarm, let's take a deep dive into the factors causing the current labor shortage in construction, and how our industry as a whole can mitigate its negative impacts with culture overhaul and preconstruction technology.

Current Labor Shortage Situation

Construction workers leave their jobs in droves for multifaceted reasons, but not because of a housing bubble anymore. In fact, construction employment increased from March to April 2021 in 26 states but still trails behind the pre-pandemic peak levels of February 2020.

So, what causes the historic highs of labor shortage even when the industry hints at recovery? Construction sectors play a part. Heavy pent-up demand for limited housing supply means extreme material price increases and long lead times for site delivery. This leads to a domino effect of delayed project starts, fewer construction workers on-site and ultimately, labor shortage if turnover rate is high.

While red-hot housing inflation is on the rise, infrastructure demand is on the low. Ken Simonson, the Chief Economist at Associated General Contractors of America (AGC) said:

"Even where employment has topped pre-pandemic levels, the gains are likely due mainly to feverish homebuilding and remodeling, not to widespread resumption of nonresidential building and infrastructure projects.”

To boost demand for this $1-trillion sector and address the labor shortage, President Biden recently signed the AGC-backed Bipartisan Infrastructure Bill into law this November 2021, aiming to add 1.5 million jobs per year for the next 10 years.

Great Resignation

While these figures signify a positive outlook for the construction industry, this begs the question: What makes this current labor shortage worse, and peculiarly different to say the least, from the past shortages?

Enter the Great Resignation, coined by organizational psychologist Anthony Klotz when 4.6 million US workers quit their jobs in July 2021. With the Covid-19 pandemic changing new norms of living and more people working from home than ever, filling in 430,000 construction jobs this year and 1 million over the next two years poses a real challenge to the construction industry.

Industry leaders have been aware of this looming talent crunch for a decade, citing the aging workforce as a critical factor to solve the lack of younger and qualified construction workers in the pipeline. And with the Great Resignation factored in and all the psychological stressors that come along with it as change catalysts, the construction labor shortage just multiplied exponentially nearly two years into the pandemic

Work-Life Balance

Is there a light at the end of the tunnel? In the US Chamber of Commerce Commercial Construction Index (CCI) for Q3 2021, 93% of contractors who expressed high concern with finding skilled workers expect the labor shortage to persist or exacerbate in the next six months.

Upskilling your entire workforce is a great investment that can pay dividends in the long run, especially when competitors try to poach your existing employees and attract them with higher wages. Staying competitive in a tight labor market means raising and cross-checking your compensation packages not only in the construction industry but also across industry verticals recruiting younger talents.

Construction workers can make $32.86 an hour, twice the average entry-level rate in the restaurant and hospitality industries, according to BLS. But despite this cost leverage, pandemic burnout has been a key driver in the Great Resignation on why we see higher construction worker churn rates than retention rates.

Entry-level construction workers would rather choose to take a small pay cut and leave the industry in search of greener pastures with decreased physical workloads and flexible jobs. Simonson said, "If other jobs are paying $15 to $17 an hour with bonuses, suddenly a construction firm that is paying $19 to $20 an hour doesn't seem as attractive."

Aging Workforce

Competition is fierce across industry verticals as the construction industry loses more workers than they bring in. Recruiters capitalize on this collective reassessment of work as they target Millennials and Gen Z to replace the baby boomer construction workforce, with a median age of 43.

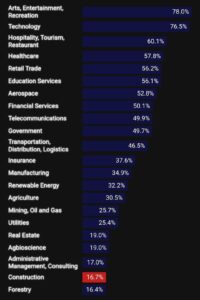

This chart from Construction Dive gives insight into industry interest.

This chart from Construction Dive gives insight into industry interest.However, stark data shows that in a ranking of 22 industries, construction placed only second to last, attracting only a meager interest of 16.7% of Gen Z from the slice of the pie, compared to booming industries like tech and healthcare.

In a 2021 Workforce Survey by AGC, data shows that the lack of skilled construction workers affects 70% of union contractors and 74% of open-shop firms, with 58% of both respondents reporting that unemployment insurance keeps construction workers away as they make more money off these stimulus checks than working.

How do you combat the construction labor shortage when the industry lacks a healthy talent pipeline and struggles to retain its current workforce? Unlocking the power of a multi-generational workforce starts with a mindset shift.

Building Better With a Resilient Workforce

There's not a one-size-fits-all approach that can single-handedly solve the construction labor shortage, especially when you deal with generational differences in the workplace. It all starts with changing the narrative.

“I don’t believe it's so much a labor shortage, as a shortage of leaders who know how to lead the next generation. Millennials and Gen Z want to have a mission to get behind," said Benjamin Holgrem, president of Buildwitt Jobs.

Uptick in Shop Classes

In the AGC survey, almost one-third of firms take ownership of this workforce problem with increased spending on training and professional development. Shop classes are also making a comeback, with 37% of firms enticing a younger pipeline and engaging with career-building programs at the high school, collegiate, and technical levels.

Often, these technical barriers hinder these younger demographics from entering the construction workforce in the first place. But when there's a collective effort in the preconstruction industry to merge tactile learning styles with early field exposure in its trade tools, systems and methods, this can help alleviate the concerns of the aging workforce and build up the essential knowledge transfer needed for these younger cohorts.

Diversify with Alternate Pipelines

Numbers don’t lie: Of the 10.8 million construction workers, nearly 90% are white while women only make up 11% of the population, and only fill just about 3% of the hands-on jobs compared to their counterparts, according to the Department of Labor.

One way to solve labor scarcity? Go beyond the construction industry, break down social stigmas with inclusive practices for all genders and ethnicities, and invest in training marginalized communities to create viable talent pools including people of color, military, and correctional facilities.

Easier said than done since wide disparity in the construction workforce has always been prevalent, but these untapped markets have the potential to bridge the labor gap with the right execution of leadership.

Leverage Construction Technology

Struggling to get the buy-ins of Millennials and Gen Z? Build a tech stack. Gone are the days with outdated, manual processes slowing down the preconstruction data lifecycle. In an industry ripe for innovation, construction takes a cue from the tech industry to create streamlined solutions and support agile workflows for efficiency.

Cash flow is king in construction, needing accurate cost points in the whole project lifecycle. Once you deploy the workforce strategies above with construction technology to solve the labor shortage, the possibilities are limitless.

Investing in young minds to leverage the 5D BIM, data visualization, and what-if analysis of cloud-based SaaS estimating and bid leveling platforms can open up a whole array of functionalities that can lead to an improved ripple effect on project, portfolio, and industry-wide levels.

Solving the construction labor shortage is not an overnight success, but a sustainable collective endeavor from all industry players.

-1.png?width=112&height=112&name=image%20(4)-1.png)